An Overview of Pernod Ricard

The world's second-largest distiller started by dominating the French absinthe market and leveraged that into a brand shopping spree that now plays in just about every intersection of the market

When I said last week that I was going to start with Pernod Ricard, I imagine that got a blank stare from many of you. More than 6 years ago I did mention using Pernod in place of a “true” absinthe in a Corpse Reviver #2, though, so perhaps you remembered that (I did not…)

The Corpse Reviver #2 - Hangover Cure Turned Classic

The Corpse Reviver #2 is the more popular of the two corpse reviver drinks that were created in the late 19th century. The drinks are extremely different, with #1 being a riff on a Manhattan and #2 being its own beast entirely.

But I imagine if I said that I was starting with Absolut Vodka, or Beefeater Gin, or Chivas, or even Mumm Champagne you would have nodded along knowingly. Well, that’s exactly what I’m doing. Pernod Ricard is the 2nd-largest company in the business of making and selling wine and spirits today, even though neither of those eponymous brands really gives that indication.

Company History and Profile

In some ways, this is a 200+ year-old company with a rich history and in some ways it’s a product of consolidation in the late 80s that doesn’t have much of a discernable soul and is simply comprised of a constantly-rotating “house of brands” that exist independently and leverage a small set of shared services.

Pernod Ricard exists somewhere on the spectrum between the dueling (French) fashion empires of Hermes and LVMH, and I really think it might be smack dab in the middle. A fashion industry hypothetical that feels like a good fit to me is “What if Bernard Arnualt was actually Christian Dior’s grandson?” We’re doing fashion comps because we’re doing a French company and because I have spent too much time in the last few months listening to the “luxury series” from Acquired.

Brief History

I could tell you just to read the Wiki, but that’s no fun. So I’ll put my own spin on it instead. Because that’s more fun.

Pernod was probably the first absinthe distilled in France, it just wasn’t called Pernod for a very long time. It was extremely popular in the 19th century and, after prohibition (and world wars), became very popular again in the mid 20th.

Ricard, by comparison, didn’t really exist at all until that second wave of popularity - the brand capitalized on the demand vacuum at legalization because so many of the old distilleries were no more. The founder, Paul, also built the major French racing circuit (though I doubt we’ll see more F1 races there at this point) and was the first (non-newspaper) sponsor of the Tour de France. Cool dude!

The brands competed fiercely, especially at home, but merged suddenly in 1975 to create an absolute absinthe monster under the business leadership of the Ricard family. They were content dominating that category alone until 1988 when they bought Jameson, and from that point it was off to the races and brands entered the house at a frankly alarming rate.

The best insanity during this spree is that for some reason they owned the bottled chocolate not-milk drink Yoo-hoo for some reason. The 90s were wild.

In 2015, Alexandre Ricard became CEO at 43, the third generation of the Ricard family at the helm of one of the largest companies in the country.

Current Profile

Today, the company explicitly markets itself as a “brand builder” and would not necessarily claim any top-level bona fides as a distiller, brewer, or vintner. It also does not tout an explicitly French identity, which makes sense since so many of the brands they’ve acquired are national talismans of other countries. There are over 240 brands in the portfolio, and at least 70 have their own web presence with 18 in the top 100 globally. The company considers its greatest competitive advantage to be the diversity represented by this portfolio.

Those brands run the gamut from well-dweller Seagram’s to high-end Monkey 47 gin, and I think you can find at least 1 of them in every country that allows the sale of alcohol.

They are also now in the business of more than just making and selling their own products; in 2024, they purchased The Whiskey Exchange and act as a retailer of many competitive products as a result.

The company is comprised of nearly 20,000 employees and produces at nearly 100 unique sites.

Financial Performance and Highlights

I’ve worked for a whole lot of American public companies, which often involves researching many other American public companies, and one of the worst parts is how truly boring and formulaic annual reports are. Yes, it makes them easier to digest. But, other than key ratios and segment breakouts, you almost never learn anything.

But Pernod Ricard is a French public company. And their annual report is gorgeous. Granted, there’s not really much in the way of financial performance in that format, but still!

Overall, there’s very little true financial detail that I can find. Here are the key stats that matter:

FY24 Sales - €11.6 B

FY24 Material Margin - 60%

FY24 Operating Margin - 27%

FY24 EBIT Margin - 24%

5-Year Sales CAGR - +5%

5-Year EBIT CAGR - +7%

Unfortunately, nothing but Sales breaks down to any deeper level (region and brand views follow this). Usually what’s most interesting, and where real insight lives, is how profitability differs at different intersections as sales don’t speak much to true strategic execution. But, we’ll make due. Here are my overall takes at this high level:

The margins here are fantastic. ~$25 coming out as pure profit for every $100 sold is aspirational for a company that both manufactures and markets directly

And it’s even better that the growth in profit is exceeding the growth in sales - the business looks to be getting more efficient during a period where that’s been hard to pull off

There’s some cause for concern, as growth rates would look much better but for the fact that FY24 was essentially flat - could be a sign that the growth train is ending

For a business like this, growth figures can be hard to trust because growth is literally bought via brand acquisition. I’d love to see / build a view of what this looks like only for brands that have been in the portfolio that whole time to see what’s “organic” versus what was acquired

If growth is from acquisition only, that’s not necessarily a problem so long as you believe they can keep picking winners to that degree, but I don’t like my chances of estimating this here

It can also be interesting to see how effectively the parent can grow an acquisition, and on what cadence - if they’re just buying sales that stay steady, that’s a horse of a different color than if everything that comes on board joins a rocket ship

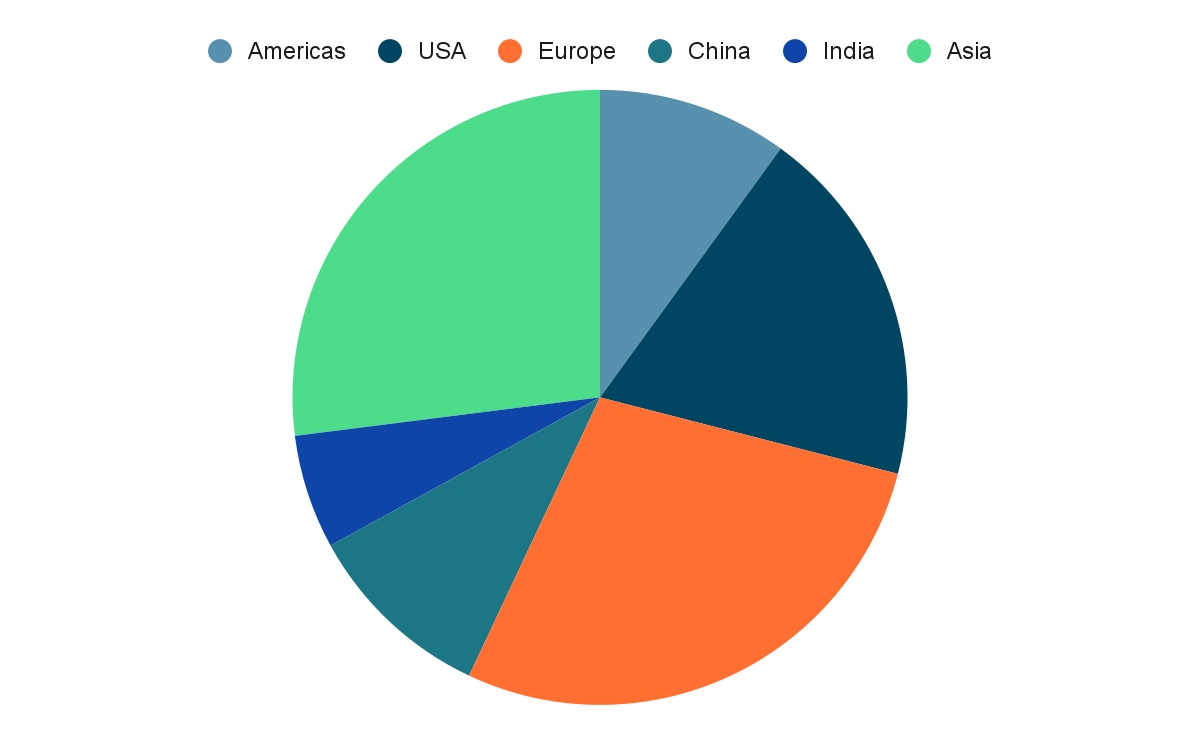

Regional Footprint

For the most part, Pernod Ricard talks about the world as the Americas, Europe, and Asia ROW (Rest of World). And each of those 3 “regions” is about equal in sales, though Asia ROW has been the largest for the last 2 years and is the only one to experience growth from FY23 to FY24.

But occasionally, they talk about specific countries as well, and that gets a bit more interesting:

A few things pop out to me in this more detailed view:

The USA is by far the largest single country, making up nearly 20% of the total portfolio volume

China at only 10% (compared to 33% for the rest of Asia) is also interesting - have to expect there’s immense headroom for growth there

India at 6% is a similar story

I really want to know how much of Europe’s 28% share is from France. What piece of the empire today is still that domestic absinthe monopoly?

Brand Performance

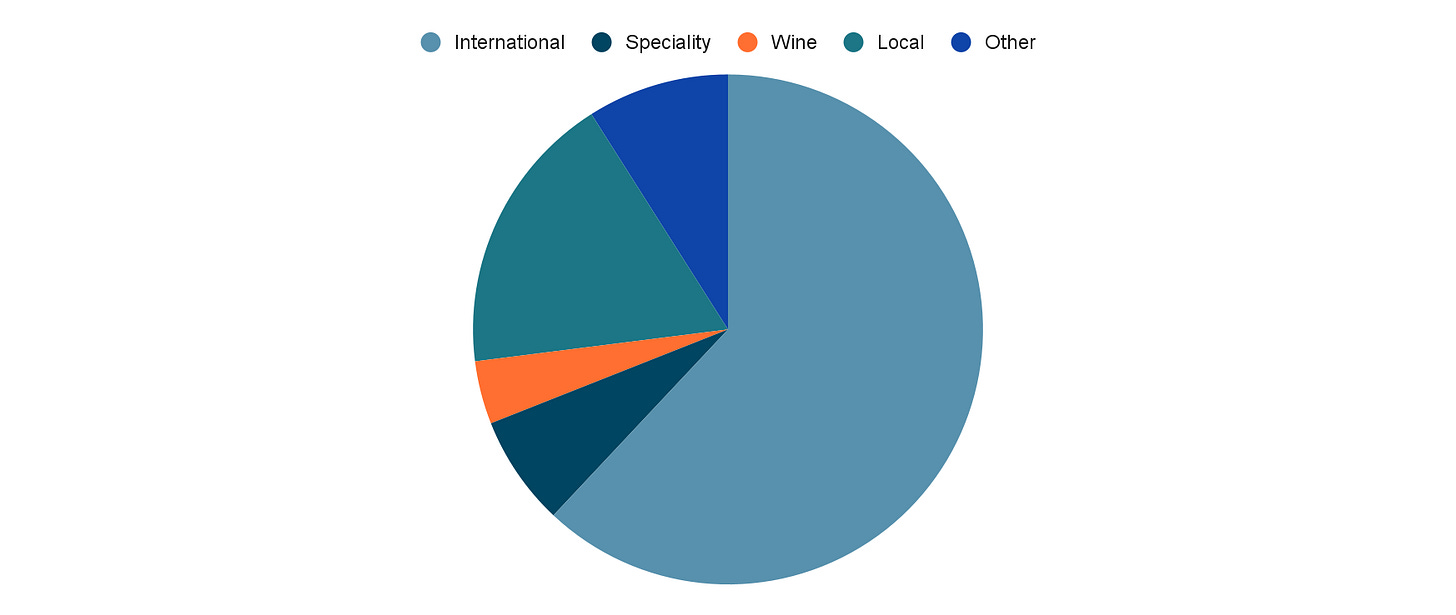

The Market Map is important because of the chart you’re about to see. Pernod Ricard talks about their brands in 5 categories, only one of which makes obvious sense, and which do not at all map to what they share on their website for some reason:

Strategic International Brands - the big heavyweights of the portfolio

Specialty Brands - smaller-volume, higher-dollar bottles

Wine - self-explanatory (except that their top Champagnes are in Strategic International)

Local Brands - products that tend to be sold only in a specific country or region

Other - everything else, generally ready-to-drink or non-alcoholic products

Here’s how those sales stack up:

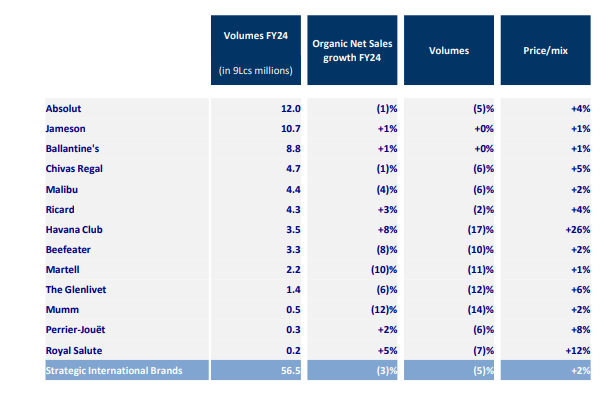

Obviously, this is really a story about the International brands - they drive 62% of all sales! And luckily, for these 13 brands, we can see even more detailed sales in a different version of their annual report:

So really, this is a story of Absolut, Jameson, and Ballentine’s. Those 3 brands make up nearly a quarter of all sales for the full portfolio of more than 240! There’s top-heavy, and then there’s this…

A few more thoughts on brand performance:

Local brands are the only category that saw growth from FY23 to FY24 - does that speak to real change in the market with emerging local preference, or was that a blip?

Wines declined by 9% from FY23 to FY24 - yeah it was a tough year for wine, but I don’t think it was that bad. And it’s not like this would look better if you brought in the big Champagnes - those were both down about as much!

Speaking of: No International brand saw volume growth, but they all saw price growth. How long can that keep up? And is that what may be driving some switch to local?

The Pernod Ricard US Market Map

I’ve been thinking of the best way to fill this out for a first pass, and I think I’ve aligned to the simplest:

If Pernod Ricard sees itself as a true brand builder, then brand count in every intersection is going to be the best way to assess their relative strength.

Here’s what that looks like, to the best of my knowledge categorizing their full brand page:

A few things stick out:

This looks like a Whiskey and Gin company, and I can see that - Jameson, Glenlivet, Chivas, Beefeater, Malfy, and Monkey 47 are all big time!

The 1 Vodka brand is Absolut which has approximately 1 billion expressions, so shelf presence and the market map will absolutely disagree on that one

If I were doing this for real for real, average slots in stores is probably the right way to look at this, and that would account for the house-within-a-house that is Absolut

Their “Ingredients” are what built the company, but they really get washed out in this view. I’m sure that’s less true at home in France where you see Pernod, Ricard, and Lillet everywhere, but I think it’s true here in the US